China is prepared to invest billions of euros in Spain, as Prime Minister Pedro Sánchez announced upon his return from an official trip to Beijing last April. However, this proposal is not without conditions. China is putting pressure on Moncloa to ensure that the investment plan is linked to a “guarantee” that Chinese mining companies – or companies with Chinese capital – will receive priority access to mining sites for lithium, beryllium, niobium, tantalum, and other minerals considered “critical.”

Deposits of these minerals are particularly rich in Spain, especially in the Iberian Belt, which stretches across the peninsula from the Cantabrian Sea to the mouth of the Guadalquivir. The exploration and development of these deposits is, in principle, open to any company, but this could soon change. Moncloa is planning a national mining exploration program that will focus on the search for these rare earths, which are of strategic importance to China and strategically important to the technology and defense industries, over the next four years, until 2029. This program will allow the government to declare reserves for resources of special interest to the state, giving Moncloa the opportunity to decide which company will receive the mining rights. China has already indicated its interest in participating.

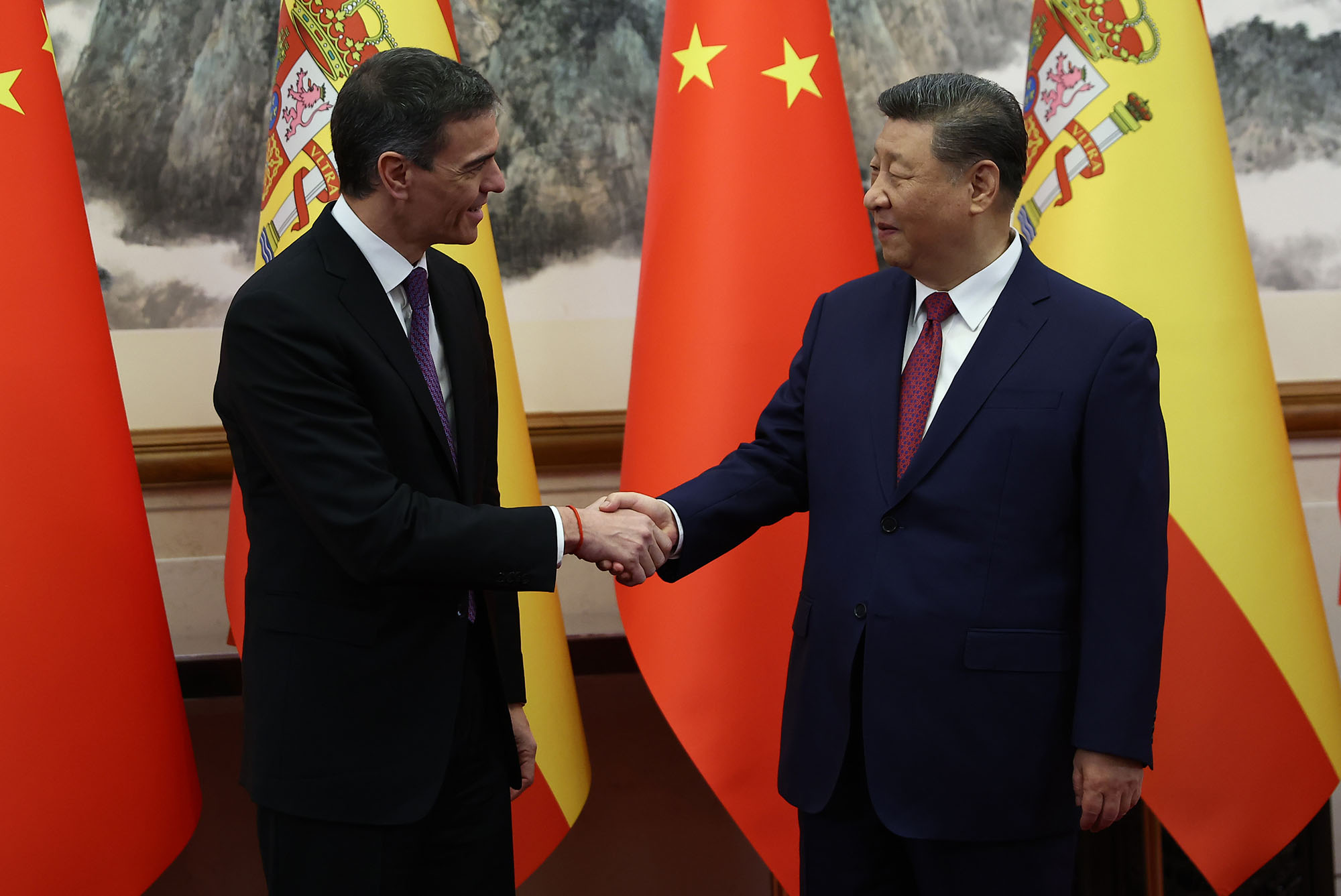

Sánchez returned from China with the promise that Beijing would bring Spain a series of billion-dollar investments, which would in turn create thousands of jobs. He reached this conclusion after discussions with Chinese businessmen from various sectors, including renewable energy and electric vehicles.

A key argument Sánchez used to convince the Chinese was the fact that Spain has one of Europe’s largest reserves of critical minerals and rare earths essential to these sectors, such as lithium (for batteries), tantalum (for electronic devices), and niobium (for turbines), to name a few. Some of these minerals are found exclusively in Spain.

Sources in the mining sector report that the conditions under which China intends to increase its involvement in Spain became clear during the trip. Beijing is demanding from Moncloa “guaranteed” and even “priority” access for its mining, exploration, and extraction companies to the vast deposits of critical minerals and rare earths still found in Spain’s subsoil. Particularly affected are the areas defined by the Ministry of Ecological Transition as part of the Iberian Massif, namely “Iberian Center,” “Ossa Morena,” and “Portuguese South,” collectively known as the Iberian Lithium Belt.

In addition to lithium, which is crucial for battery production—one of the industries China plans to develop in southern Spain—this area is also rich in other minerals classified as “critical” by the European Union, such as tantalum, beryllium, tungsten, niobium, fluorite, feldspar, and silicon. There are also particularly important minerals such as magnesite and strontium. Spain is the second-largest producer of magnesite in the EU and the only country with reserves of strontium, a radioactive isotope used medically to treat cancer. Coltan, essential for smartphone batteries, is also found in Spain; the only mine in Europe is located in Penouta, a small village in Orense.

Sánchez has decided to push ahead with this search.

China’s efforts in these areas have found an ally in the Spanish government, which has revived an initiative dating back to the Franco era: the National Mining Exploration Program. This program was last implemented in 1969. Between 2025 and 2029, the Ministry for Ecological Transition, under the leadership of Sara Aagesen, will promote and subsidize the exploration and cataloging of all deposits of these critical minerals and rare earths in Spain, with a particular focus on the Iberian belt. Chinese companies have already expressed interest in participating in this process, which will enable the government to gain an accurate picture of the deposits and their potential for extraction.

This program has fundamental implications for the government: It will enable it to control mining in the future through competition. If a significant deposit of one of these minerals is discovered, a special regime for reservation zones in these areas can be established for the benefit of the state, taking into account economic, social, and even national defense criteria. This will give the state the opportunity to directly or indirectly through tenders. Industry sources explain that this is the point at which China can assert its position to secure control over the deposits.

Current Projects

In March, the European Commission approved a list of 47 strategic projects to strengthen national capacities in the field of strategic raw materials. This was the first time such a list had been published, and it includes seven projects for the extraction and processing of rare minerals in Spain. The exploration for lithium, copper, tungsten, cobalt, platinum, and nickel is being carried out at sites in Extremadura, Andalusia, Castilla-La Mancha, and Galicia.

Brussels stated that lithium will be extracted in Las Navas (Cáceres) and Doade (Orense). For tungsten, the site in Abenójar (Ciudad Real) has been selected, while another site south of Mérida, the capital of Extremadura, remains unknown. The extraction and processing operations for this final project are being carried out by Iberian Resources Spain SL.